The UK insurance and reinsurance industry is navigating a period of rapid transformation, marked by regulatory reform, accelerating cyber threats, and shifting macroeconomic conditions. With a combined market valuation of £74.6 billion and forecasted earnings growth of 18% annually, the sector remains resilient despite global volatility, reflecting strong investor sentiment and long-term growth confidence. With this, the UK regulators continue to sharpen their focus on operational resilience, urging financial institutions to fortify themselves against cyber disruption and systemic vulnerabilities.

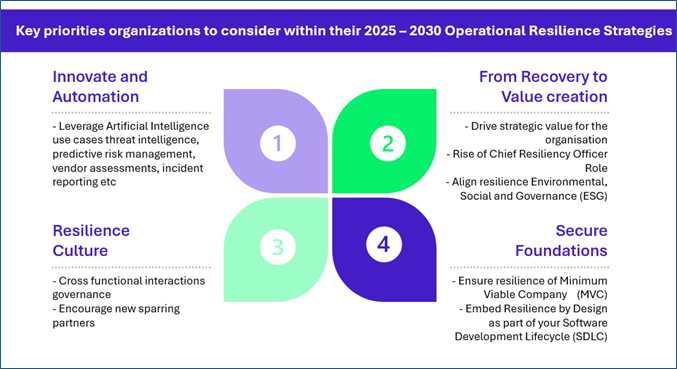

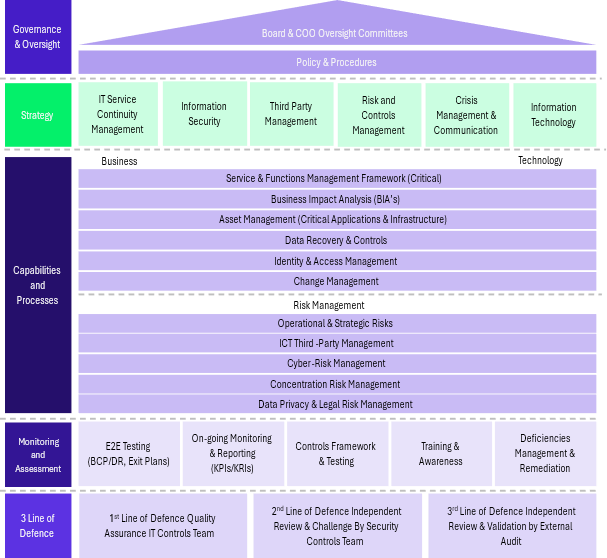

In recent years, regulators have consistently urged insurers to adopt holistic strategies that extend far beyond traditional disaster recovery—embedding resilience throughout business operations and the entire software development lifecycle.

This paper aims to offer a comprehensive perspective on resilience, bringing together operational continuity, cyber defence, and third-party risk management. It can serve as a strategic guide for CxOs, outlining how to identify the Minimum Viable Company (MVC), market insights into sector-wide impact tolerance, and anticipate the evolving landscape of regulatory and cyber resilience through 2030.

Minimum Viable Company (MVC) framework

The FCA’s Operational Resilience Policy Statement (PS21/3) challenges insurers to pinpoint their Important Business Services (IBS) and develop strategies for maintaining these during severe disruptions. Though MVC is not named explicitly in PS21/3 (FCA’s Policy Statement on Building Operational Resilience, published in March 2021) organizations are advised to define their “minimum operational footprint,” closely aligning with MVC principles.

Think of the MVC as your organisation’s lifeline: those indispensable services, processes, technologies, and teams that maintain trust and financial stability, even when everything else must be paused.

Most organizations keep their MVC lean, just 15–17% of total business activity, backed by robust lists of mission-critical applications, core infrastructure, key data, and vital third-party relationships. This isn’t just compliance: it’s about identifying a modular, scalable foundation that lets your business isolate issues, recover fast, and keep delivering during systemic risks.

Informed by our extensive work with top UK and global insurance organisations, an indicative list of Core Services typically is:

|

Category |

Key Services |

|

Policyholder Protection |

Claims processing, policy issuance, renewals, cancellations |

|

Financial Continuity |

Premium collection, solvency monitoring, payment execution |

|

Compliance |

AML screening, sanctions checks, conduct and transaction reporting |

|

Customer Engagement |

Complaints handling, contact centre operations, digital portals |

|

Underwriting & Risk |

Quoting, risk analysis, reinsurance placement and management |

|

Third-Party Oversight |

Broker relations, outsourced claims handling, vendor contracts |

Further examination of trends in impact tolerance, detailing standard timeframes observed and strategic rationale for core services identified within MVC.

Note: The following ranges are intended as guidance, reflecting our market study and regulatory advisory. Actual tolerances may vary based on factors such as the jurisdictions involved, the organization’s risk profile, and its financial capacity.

|

Service |

Tolerance Range* |

Strategic Rationale |

|

Claims Processing |

4–6 hours |

High customer sensitivity |

|

AML/Sanctions Screening |

Real-time to ≤1 hr |

Regulatory zero tolerance |

|

Premium Collection |

1–2 business days |

Financial viability risk |

|

Contact Centre Operations |

2–4 hours |

Reputation and customer satisfaction |

|

Policy Issuance |

24–48 hours |

Tiered based on product complexity |

|

Reinsurance Placement |

3–5 business days |

Indirect impact on front-line policyholders |

|

Broker Connectivity |

1 business day |

Continuity of sales and distribution |

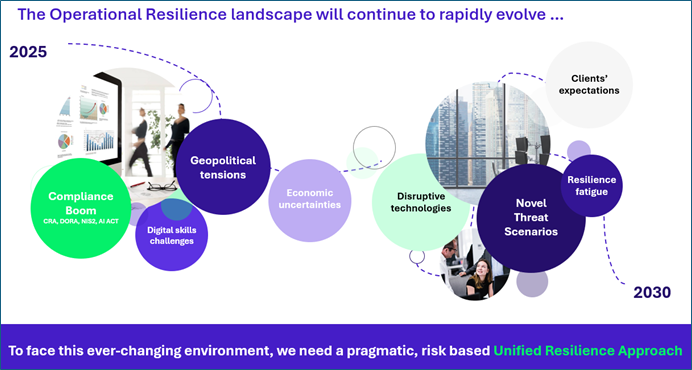

Regulatory trends: 2025–2030 outlook

As the insurance industry navigates evolving operational demands, it is equally crucial to anticipate the shifting regulatory landscape that will define the coming years. The following outlook highlights the major regulatory trends projected for 2025 through 2030, outlining key compliance requirements and anticipated changes that will shape the UK insurance sector’s risk management and reporting frameworks.

|

Timeframe |

Topic |

Expected Development |

Principal Regulator(s) |

|

Q4 2025 |

Financial Conduct Authority (FCA), Prudential Regulation Authority (PRA) Incident Reporting |

Real-time and layered disclosures mandated |

FCA, PRA |

|

2025-26 |

UK Cyber Security and Resilience Bill |

Modernize the UK’s cyber security framework and strengthen regulations. |

Information Commissioner’s Office (ICO) |

|

2025–2027 |

Critical Third-Party Oversight |

Prescriptive governance for cloud, data and service providers |

FCA, PRA |

|

2026 |

PRA DyGIST Resilience Stress Testing |

Sector-wide stress testing for liquidity and capital |

PRA |

|

Q2 2025 |

Climate Risk (SS3/19 update) |

Expanded stress testing and governance mandates |

PRA |

|

2025–2030 |

Captive Regulation Reform |

Modernisation for UK-based captives under review |

PRA, FCA |

It is important to recognise that as regulations in this area continue to develop, UK regulators such as the FCA and PRA are moving towards greater alignment with major European frameworks, including the EU Digital Operational Resilience Act (DORA) and the Network and Information Security (NIS) Directive.

This alignment reflects a recognition of the interconnectedness of financial markets and critical services across borders, and the need for consistent, elevated standards of operational and cyber resilience.

The FCA and PRA have issued consultations and guidance signalling their intent to integrate core DORA and NIS principles—such as enhanced third-party risk management, harmonised incident reporting obligations, and sector-wide resilience testing—into the UK’s regulatory regime. This convergence ensures that UK financial institutions, insurers, and service providers are prepared not only for domestic regulatory expectations but also for the demands of operating within a global and digitally integrated market.

Boardroom resilience checklist

In light of these forthcoming regulatory changes and strategic reforms, it is essential for boardrooms to evaluate and reinforce their organisational resilience frameworks. The following checklist is designed to guide leadership teams in proactively assessing their preparedness, ensuring robust governance, and embedding resilience into core decision-making processes.

- MVC coverage: Is your Minimum Viable Company (MVC) clearly defined, mapped, and stress-tested across operations to maintain delivery of essential services

- Impact tolerance benchmarking: Have you validated realistic impact tolerances through scenario analysis, and benchmarked them against peer institutions and regulatory frameworks

- Third-Party risk visibility: Do you maintain real-time insight into key external dependencies, supported by contingency planning and contractual resilience provisions

- Integrated resilience functions: Are your operational resilience, cyber security, third-party risk, and enterprise risk teams aligned in strategy, decision-making, and board reporting to support a cohesive resilience posture

- Incident Response preparedness: Do you have robust mechanisms for multi-channel incident reporting (internal and external) and active regulator engagement, supported by rehearsed playbooks

- Cyber insurance alignment: Is your cyber insurance coverage tailored to your specific risk landscape, and tested against evolving threat scenarios across business-critical assets

- Board accountability: Have board members been trained in resilience and security oversight, and do they receive regular briefings from integrated risk functions to ensure informed governance

- Resilience culture: Is a resilience-aware culture embedded across the organization —from executive leadership to operational teams — fostering proactive risk ownership and continuous improvement

- Regulatory awareness & horizon scanning: Are we tracking global and local regulatory developments (e.g. EU DORA, FCA SS1/21, SEC cyber rules), and ensuring readiness and board-level awareness of compliance obligations

The UK insurance and reinsurance sector is well-capitalised, digitally evolving, and strategically positioned for growth. But resilience (operational, cyber, and third-party) remains the defining factor for long-term success.

By thoughtfully harmonizing operational resilience strategies across function with leading global standards, organizations can elevate their industry standing and secure enduring stakeholder confidence. This proactive approach not only ensures compliance with a rapidly evolving regulatory landscape but also fortifies the ability to mitigate cross-border risks and respond decisively to unforeseen disruptions. In a world where digital threats and supply chain vulnerabilities transcend geographic boundaries, developing internationally recognised resilience is both a regulatory imperative and a cornerstone of successful, forward-looking business strategy.

In conclusion, executives must embed robust, integrated resilience frameworks for sustained growth and stability. By cultivating a culture of proactive risk management and regulatory awareness, institutions can position themselves at the forefront of operational excellence, prepared not just to withstand challenges, but to transform them into opportunities for long-term success.